Key Insights Lynx Equity Strategies recently issued cautious commentary on Nvidia Corporation (NASDAQ: NVDA), advising investors to step aside for now and wait for a more favorable entry point. Rationale Behind the Caution Valuation Concerns: Nvidia’s stock price reflects lofty expectations fueled by AI demand. Lynx notes this could limit near-term upside. Supply Constraints: Nvidia’s Blackwell AI chips face supply chain challenges that may extend into fiscal 2026, impacting delivery capabilities. Market Sentiment: Despite Nvidia’s strong fundamentals, the risk of an overextended rally might overshadow its robust Q3 earnings and outlook. API Integration Earnings Calendar API: Stay informed on Nvidia’s upcoming earnings releases for real-time analysis. Company Rating API: Access Nvidia’s analyst ratings and compare valuations with peers in the semiconductor space. Conclusion Lynx's recommendation highlights the importance of balancing Nvidia’s impressive AI-driven growth against potential risks like valuation and supply issues. This signals an opportunity for patient investors to identify a more optimal re-entry into one of the market's AI leaders.

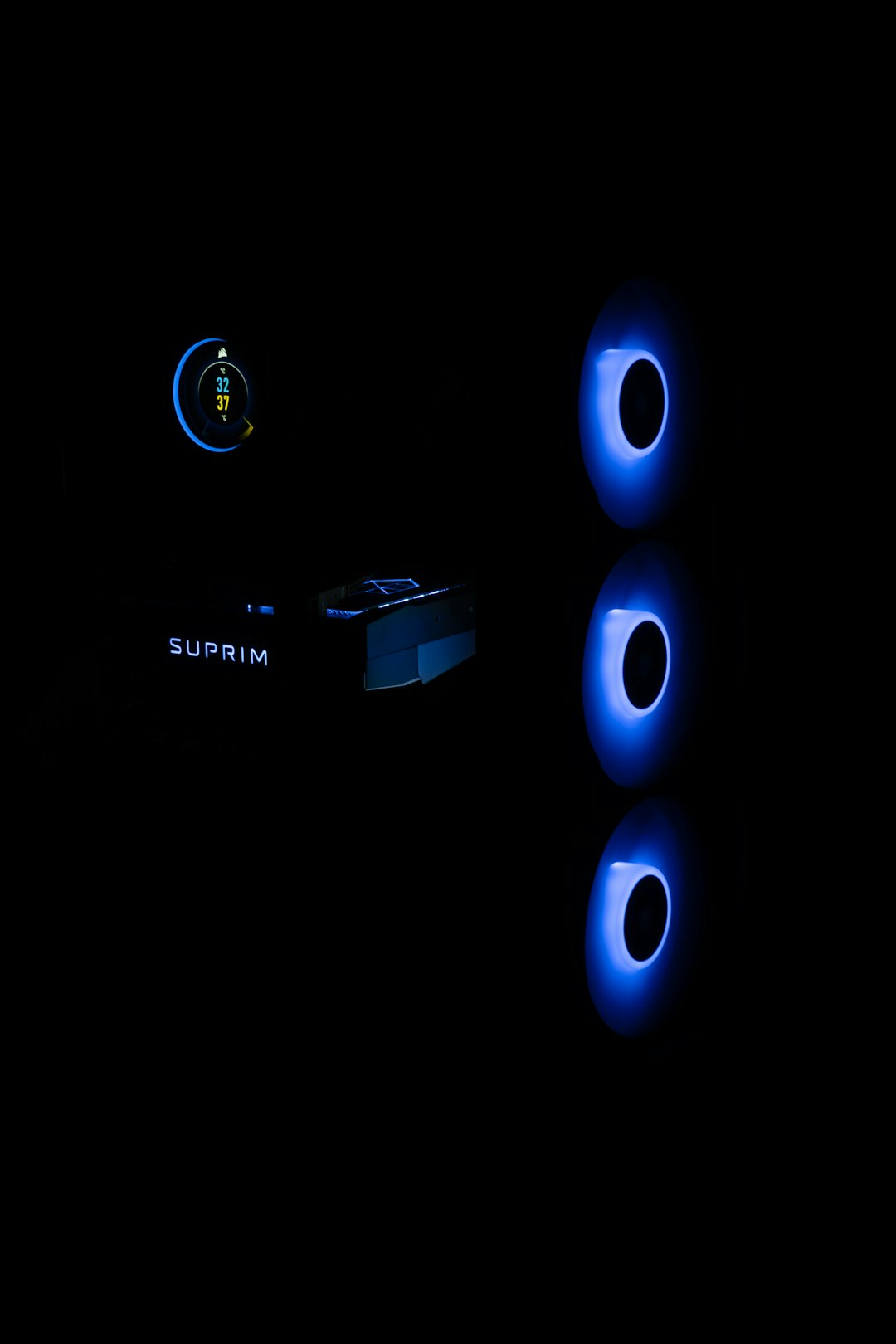

N VIDIA Corporation provides graphics, and compute and networking solutions in the United States, Taiwan, China, and internationally. The company's Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; vGPU software for cloud-based visual and virtual computing;

Price: 139.93

Market cap: 3.4 trillion USD

Eps: 2.54

P/e ratio: 55.09