Nvidia Results: A Tale of Strength with Challenges Nvidia's fiscal Q3 results showcased impressive growth, with EPS beating estimates at $0.81 on revenue of $35.1B. Data center revenue led the way at $30.8B, surpassing expectations of $28.84B, reflecting AI-driven demand. Supply constraints for Blackwell AI chips might hinder potential growth in fiscal 2026, tempering optimism. Comcast’s Spinoff Announcement Comcast Corp. plans to spin off its streaming platform, Xumo, in 2024, aiming to capture value in a competitive digital streaming market. Analysts are closely watching this move as a signal of diversification amid cable industry declines. UK Inflation Holds Steady The latest inflation data from the UK remained unchanged at 4.6% year-on-year for October. Sticky inflation numbers underscore challenges for the Bank of England in achieving its long-term targets. Relevant APIs for Analysis Earnings Historical API: Analyze Nvidia's past earnings trends and compare performance with industry peers. Commodities API: Track inflation-sensitive commodity prices like gold and crude oil to understand macroeconomic impacts. Conclusion From Nvidia’s strong results to Comcast's strategic spinoff and stubborn UK inflation, global markets remain dynamic and influenced by a variety of forces. Investors are advised to remain vigilant, balancing sector-specific opportunities with broader economic indicators.

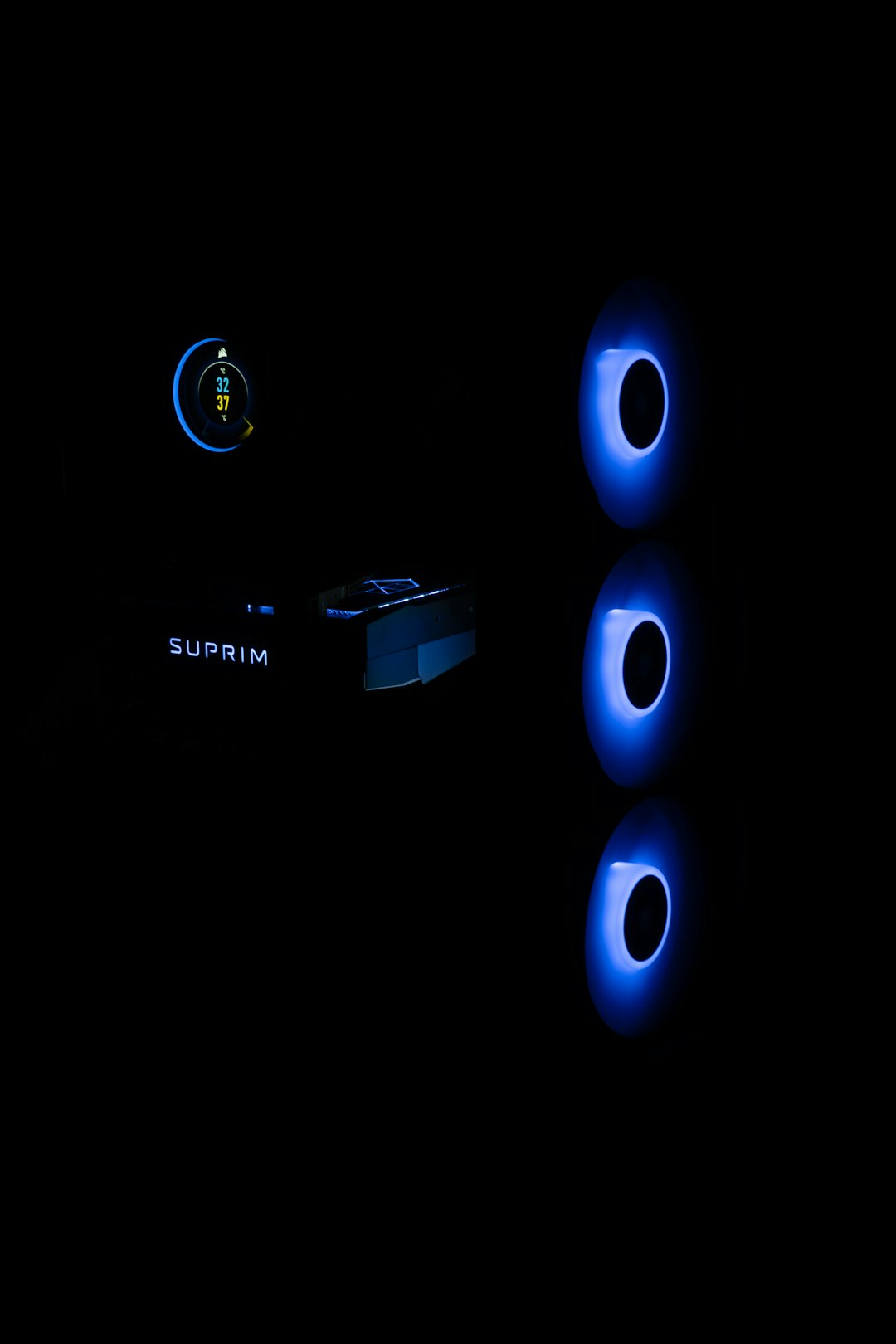

N VIDIA Corporation provides graphics, and compute and networking solutions in the United States, Taiwan, China, and internationally. The company's Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; vGPU software for cloud-based visual and virtual computing;

Price: 139.45

Market cap: 3.4 trillion USD

Eps: 2.54

P/e ratio: 54.90