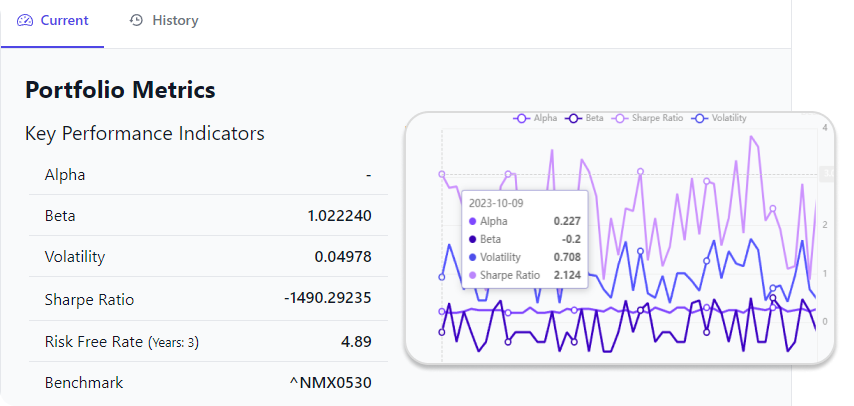

Key Performance Indicators (KPIs)

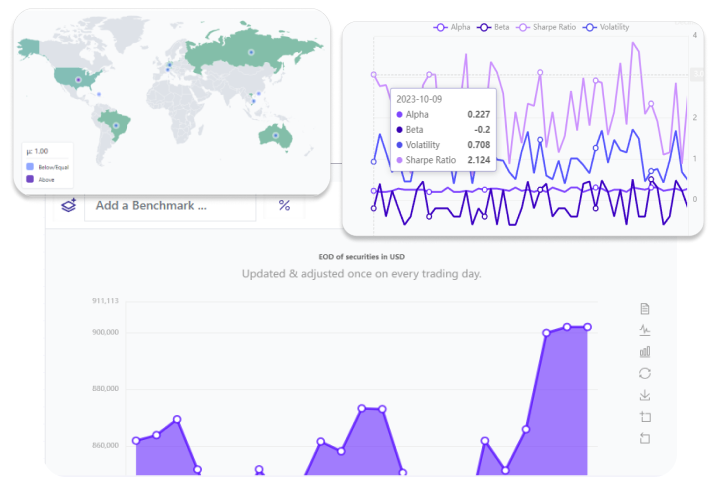

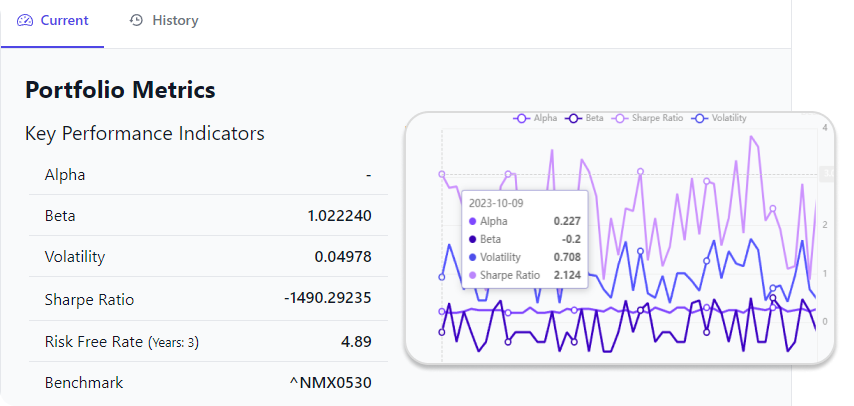

Besides other KPIs, we calculate the Sharpe Ratio, the Alpha, the Beta and the Volatility of your portfolios.

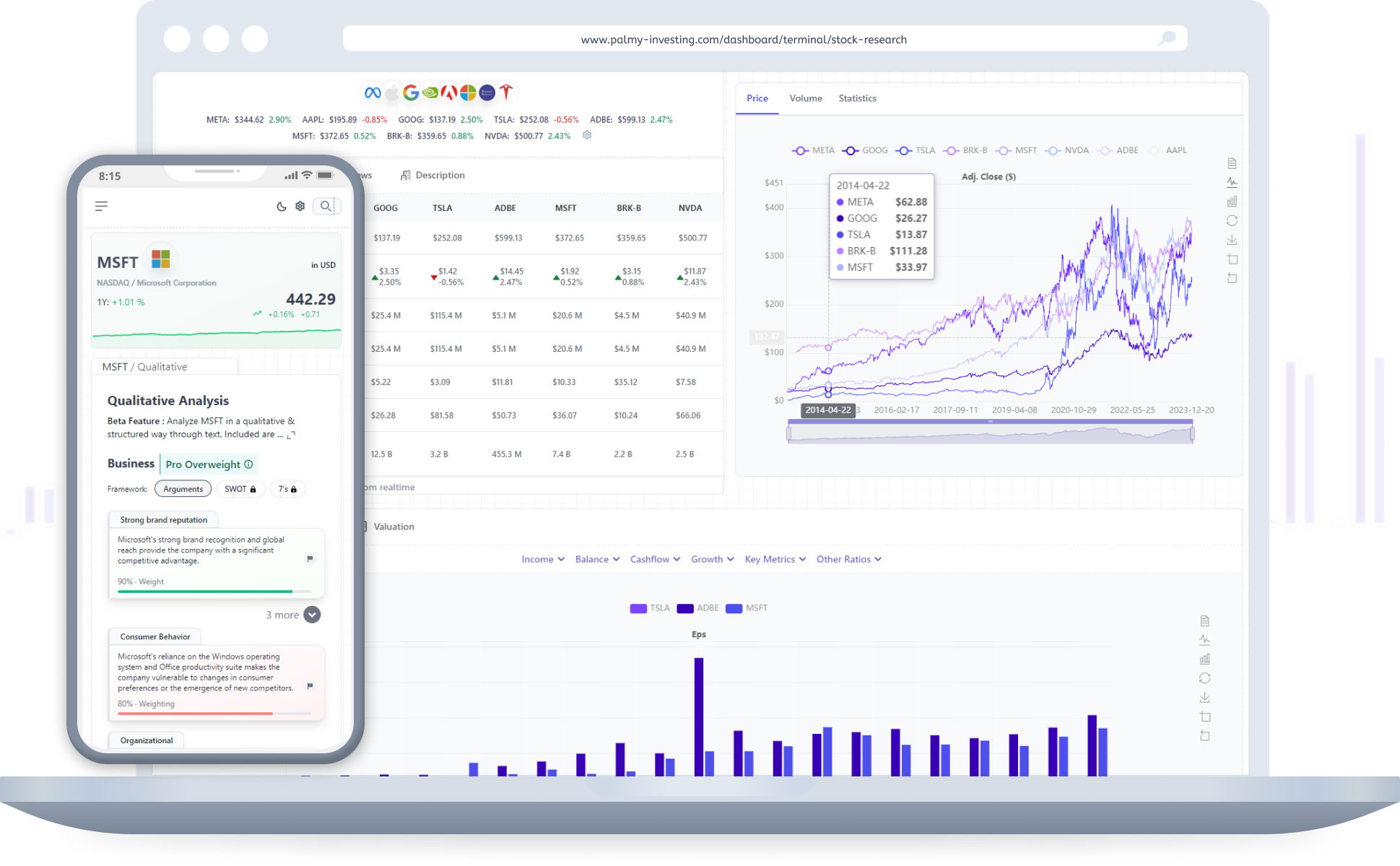

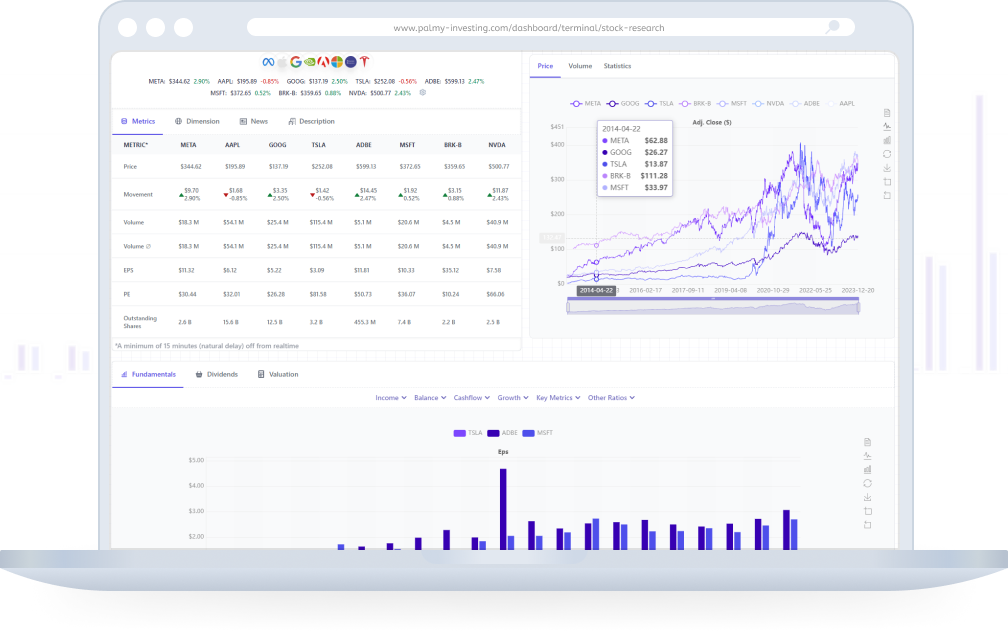

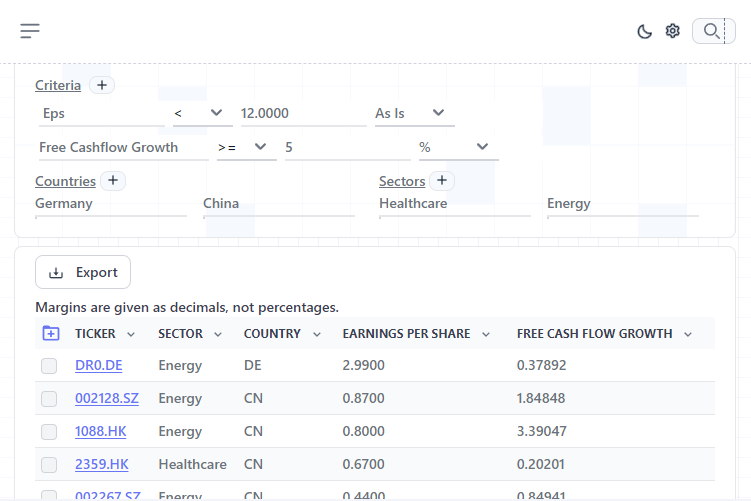

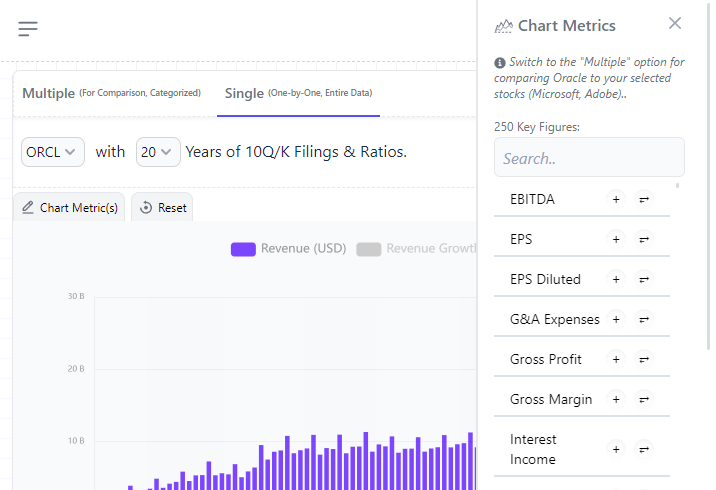

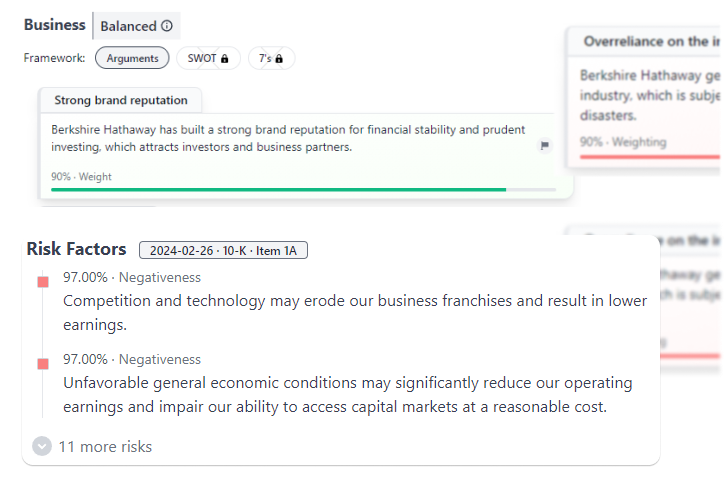

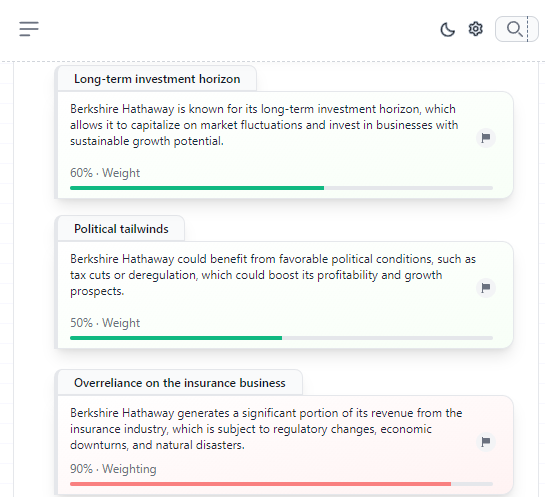

Our workspace saves you time And effort, delivering qualified investment opportunities in return.

Open The SearchBesides other KPIs, we calculate the Sharpe Ratio, the Alpha, the Beta and the Volatility of your portfolios.

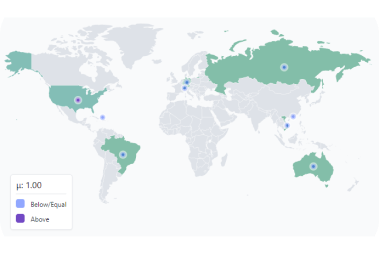

We visualize your portfolio allocation regarding: asset classes, positions weighting, sectors and countries. we provide all the statistics to your dashboard.

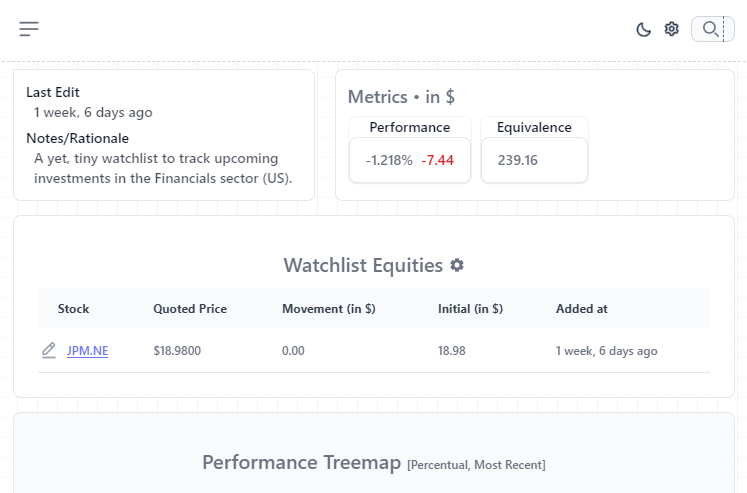

Review & plot all of your past trades. Fine-tune your Portfolio via our management system at anytime.

Use one of more than 150 benchmarks such as the S&P 500 or Dow Jones to compare it with your portfolio performance.

Get screens of your assets to track real-time financial metrics right in your portfolio dashboard

Use your own benchmark for alpha & beta or set your own risk free rate inside the Portfolio Manager.

Our membership model is transparent —.

you get exactly what you see , and nothing less.

No hidden fees for feature updates or new features —. stay in the loop and enjoy continuous improvements.

Limited Offer

Explore Palmy at your own pace. You can pay and upgrade later on.